Home Equity Loan

How to Get a Home Equity Loan With turnedaway.CA Despite Bad Credit

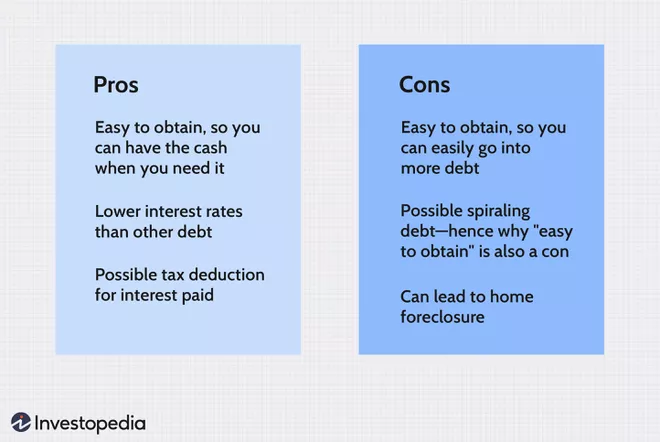

Home equity loans allow homeowners to borrow against the equity of their house in terms of any financial pressure or emergencies. With strict regulations, sometimes banks are not as flexible as advertised and do not offer easy loans. With less time, looking for companies offering fast home equity loans on flexible terms is hard.

Turnedaway.ca has services that are optimized for consumers’ convenience. They are the leading private mortgage providers and brokers in Canada. They specialize in looking into applicants that the banks turned down due to low income or credit circumstances.

Provisions

You can get a comfortable home equity loan despite bad credit due to the following provisions by Turnedaway.ca.

Bad Credit Compensation

Turnedaway.ca service providers ensure that their users with a bad credit score below 600 are catered to without much scrutiny. They grant you allowance with your home as collateral to the loan provided with maximum approvals.

This puts them at the top of the market because of their Customer-friendly demeanor keeping rules under consideration and helping their users improve their credit scores.

Competitive Mortgage Rates

This company offers competitive residential and commercial mortgages with the lowest interest rates in the market. They are efficient providers of high risk mortgage loans for bad credit borrowers, taking it as a challenge.

Flexible Terms

Turnedaway.ca claims to have solutions to any home equity loan approval issue you might face. They provide reasonable and flexible repayment terms with negligible overdue fees, making them approachable.

Time-efficient

Some companies have lagging systems and lengthy procedures to approve a home equity loan, which can be inconvenient in an emergency. Turnedaway.ca works wonders in this regard. The lender reviews the applications as soon as possible and gives you a call in just 24 hours. If further approved, you might be able to attain a debt in a matter of days, which makes their service extremely time-efficient.

Easy Monthly Payments

The lenders at this company make sure to establish budget-friendly monthly installments for the applicant. It helps you pay off your debt and keep your home expenses and credit score afloat. It may help you divide your expenses reasonably, not letting inflation and economic stress get to you.

Access to Lenders

Turnedaway.ca has access to 60 + lenders. These lenders offer their insight and home equity loan approvals to struggling people. They do not strip you of your money and have nominal fees for the assistance they are providing.

Individual Application Reviews

The lenders at this company ensure taht they avoid mass reviews to reject most of them. They try to review and work out all the kinks to maximize the user’s benefit. Turnedaway.ca works as an alternative to a bank without scrutiny and continuous rejections. They have made their mark in the market as their primary claim is to help the applicants with their financial problems.

Conclusion

People with bad credit due to low income and no regular monthly payments can face problems when opting for home equity loans. Banks and more significant establishments mostly look for pristine applications that can repay in due time. In this regard, Turnedaway.ca comes under play as a leading private mortgage and home equity loan provider with easy terms.

You can apply for a home equity loan with their online submission service. They take no time to review your application and give you a callback. They offer transparent loans with basic rules and low-interest rates. It saves you from the hassle of loan provision and helps improve your credit score.